iowa inheritance tax changes 2021

In 2022 estates worth more than. A flat and fair 39 individual income tax rate means Iowans keep more of their hard-earned pay upfront.

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

Iowa has decided to end their inheritance tax starting in 2021 and will completely abolish the tax by January 1st 2025 between now and then the Iowa Inheritance Tax will reduce by 20 per.

. When the new rate is fully enacted in 2026 98 of Iowa. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. Over four years beginning for estates of decedents passing on or after January 1 2021 the tax rate is reduced ultimately eliminating.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. It is phased in with reductions for the first few years but on January 1 2025 the Iowa Inheritance Tax will be fully repealed assuming Governor Reynolds signs the bill SF619. For deaths occurring on or after January 1 2025 no inheritance tax will be imposed.

Lower the top individual income tax rate. Complete Edit or Print Tax Forms Instantly. Federal NOLs generated and carried over from a tax year prior to the 2023 tax year cannot be deducted when computing Iowa taxable income in the 2023 tax year and beyond.

Read more about Inheritance Tax Rates Schedule. There is no federal inheritance tax in the US. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo.

A panel of Iowa House lawmakers moved a bill Monday that would eliminate Iowas inheritance tax by 2024. Cut Individual Income Taxes. Free Inheritance Information For You Your Lawyer.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax. Track or File Rent Reimbursement. In 2021 Iowa decided to repeal its inheritance tax by the year 2025.

It would also eliminate Iowas inheritance tax over three years. Iowans will now see the following tax changes go into effect Jan. In the meantime there is a phase-out period before the tax completely disappears.

The top individual income tax rate will drop from 853 to 65. The Tax Foundation reports that US. Inheritance Tax Rates Schedule.

Change or Cancel a Permit. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be reduced by 20 from the original rates. Senate amendments to the American Rescue Plan Act of 2021 ARPA prohibit using any of the 350 billion in State and Local Fiscal.

Learn More About The Adjustments To Income Tax Brackets In 2022 vs. An inheritance tax ranging from 5 15 percent however is. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

Repeal of State Inheritance Tax. Unlike the Iowa inheritance tax upon beneficiaries for the right to receive assets from a decedent the. The applicable tax rates will be reduced an additional 20 for each of the following three years.

SF 619 would phase out the inheritance tax rate over five years by reducing the effective tax rate by 20 percentage. Ad Access Tax Forms. Soon one element wont be a consideration in estate planning in Iowa.

Ad Compare Your 2022 Tax Bracket vs. If one were to die in 2022 the. Up to 25 cash back Update.

With proper planning the 2021 exclusion can be 234 million for married couples. Your 2021 Tax Bracket To See Whats Been Adjusted. House File 841 passed out of subcommittee Monday.

The law reduces the inheritance tax in five stages by reducing the tax rate by 20 per year over. Inheritance Tax Eliminated June 16 2021 As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out. Free Inheritance Information For You Your Lawyer.

The number of Iowa income tax. If the bill becomes law three changes could take effect on Jan. A state inheritance taxThe inheritance tax will be eliminated in the Hawkeye State over the next three.

The amount of inheritance tax depends on the total value of the assets and it must be paid within nine months. In addition to the Iowa inheritance tax there are other Iowa state taxes which concern estate property. Ad Get an Estate Planning Checklist More to Get the Information You Need.

Ad Get an Estate Planning Checklist More to Get the Information You Need. Iowa is one of six states still imposing a tax on certain beneficiaries of an estate. States With No Estate Tax Or Inheritance Tax Plan Where You Die.

Under current law no inheritance tax is due on shares passing to spouses or lineal ascendants and descendants. Tax rates from 5 to 15 may apply to inheritances that are not exempt. Register for a Permit.

Iowa estate tax is not applicable. Get Access to the Largest Online Library of Legal Forms for Any State. These are briefly described below.

Iowa Reduces Corporate Individual.

Iowa Income Tax Calculator Smartasset

How Do Iowa S Property Taxes Compare Iowans For Tax Relief

Which States Will Gain Or Lose Seats In The Next Congress The New York Times

What Bills Survived Iowa S Second Funnel Deadline Several Legislative Priorities Still In The Works Iowa Capital Dispatch

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

How To Avoid Inheritance Tax In Iowa

How Do Quarterly Income Tax Installments Work Moneysense

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Reconstruction Prices Rise Moderately Amid Demand For Materials Labor Visualize Verisk

Iowa Child Support Law Changes 2022

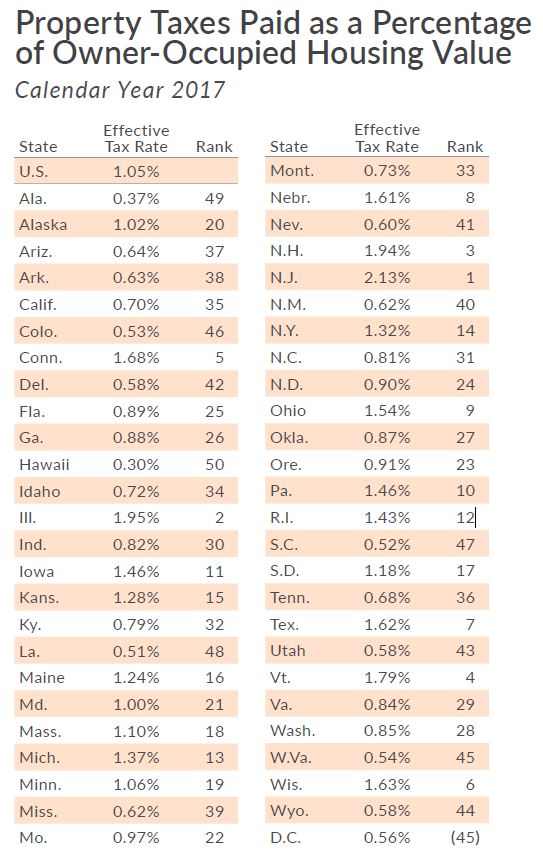

Property Taxes Property Tax Analysis Tax Foundation

Property Taxes Property Tax Analysis Tax Foundation

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Biden To Exempt Farms In Plan To Eliminate Stepped Up Basis Beef Magazine

Does Your State Have An Individual Alternative Minimum Tax Amt

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-6a117470967b4b49960be0fb69f474a4.jpg)